The Ghana Revenue Authority (GRA) recently announced that they would no longer accept cash or cheque payments at their various branches. This policy came into full effect on the 1st of July, 2021.

Before then, almost all businesses in Ghana had to go through the manual process of paying their taxes through one of the GRA branches or offices nationwide. Whilst they introduced a system to file personal income tax through their iTaPS system in 2019, there was just no option available for businesses. Until recently!

It is now possible for you to pay your taxes online to the GRA via Ghana.GOV, whether you are an individual, sole proprietor or limited liability company.

Built by 3 Ghanaian fintech companies IT Consortium, Hubtel and expressPay, Ghana.GOV is the brand name of the government of Ghana’s website which aims to streamline payments for any and all government services and plug the holes in its revenue collection system that leads to loses of over GHc2 billion a year.

It was launched on the 8th of June, 2020 and has gradually had more features and functionality added to it, including the recent ability for businesses and companies to now pay their taxes to the GRA online.

As a website design company that helps individuals and companies start and grow their business online, we do like to dive into various online implementations and opportunities to automate and make life easier for our clients.

Because we couldn’t find any useful information on how to pay your taxes online to GRA via the Ghana.GOV platform, we decided to document the entire process. We hope it’ll be useful to you.

Signing up on Ghana.GOV

The first step in paying your business’ taxes online from the comfort of your home or office is to visit the Ghana.GOV website. Do note that whilst it’s branded as Ghana.GOV, the actual url is ghana.gov.gh. If you enter only ghana.gov in your browser, you won’t find the website.

Once there, click on the Sign Up button in the top right corner of the screen. It will redirect you to their sign up page.

The details you’ll need to sign up include:

- First Name

- Other Names (if any)

- Last Name

- Phone Number

- Email Address

- Password

You’ll also have to check the small checkbox to agree to the Terms and Conditions. Once done, you can click on the Continue button.

A verification code will be sent to the phone number you specified. All you have to do is enter that into the next screen you are presented with and click Continue.

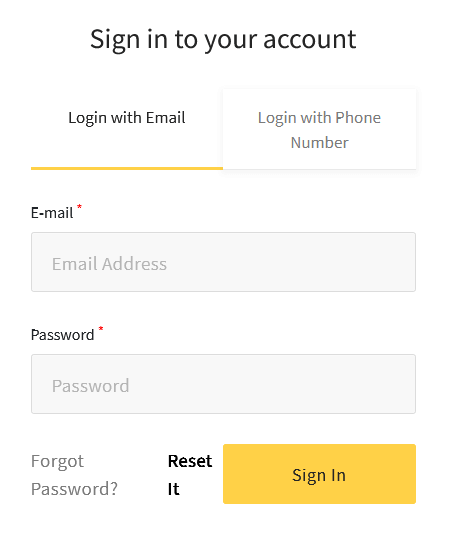

Once your verification is complete, you can now log into the Ghana.GOV website for the first time. Click on Login at the top right corner and you’ll be able to log in with either your email address/phone number and password.

You will be redirected to an empty dashboard once you log in.

Paying taxes on Ghana.GOV

To pay your taxes on Ghana.GOV, you have to be logged in and click on the Find a Service link in the navigation menu from wherever you are.

You’ll be shown the Search Directory where you can search for an agency or ministry to make your payment.

Searching for GRA in the Search For Agencies box should be the quickest method.

Alternatively, you can click on the Business tab and scroll down to find the Money and Finance option.

This will also display the Ghana Revenue Authority which is what we’re looking for.

Clicking on this now pulls up the page for the Ghana Revenue Authority. It provides some useful information about them, their mission, vision, where their offices are located, email addresses and phone numbers.

We’re looking for a nice yellow button somewhere on the bottom-right side of our screen that says File & Pay Taxes. Tapping on this should show you a pop-up menu displaying the options available for paying the GRA.

They include:

- Pay Domestic Tax Bill

- Pay Customs Duty

- File Returns & Pay Taxes

- Pay Vehicle Income Tax (VIT)

Some of the most common taxes paid by all businesses in Ghana include PAYE (Pay As You Earn), CIT (Corporate Income Tax), WHT (Withholding Tax). etc. To pay any of those, you’ll want to click on File Returns & Pay Taxes.

A pop up notice will inform you of your pending redirection to one of the GRA’s websites, taxpayersportal.com to file your taxes.

From there, you are able to log into the website in order to file your taxes. (If your Ghana.GOV details do not help you log in, you might have to use the Sign Up link.)

It’s very important you make sure you sign up with this portal because not only does it have a tremendous amount of information and functionality that you certainly require, but the GRA is making it compulsory for some taxpayer groups to file their taxes through the online portal. It’s not a stretch to believe in the near future, we’ll all need to file our taxes through the taxpayer’s portal.

Another good reason to file your taxes online via the GRA’s portal is the fact that many times, the penalty for not filing your taxes is much larger than the penalty for not paying. Technically, the GRA would have you rather file and not pay, than to pay and not file.

Whilst using the tax payer’s portal is a little beyond the scope of this article, we did find a useful video overview on YouTube which you can check below.

Once you’ve successfully filed your tax return, you will be able to select the option to pay and be redirected to the Ghana.GOV website.

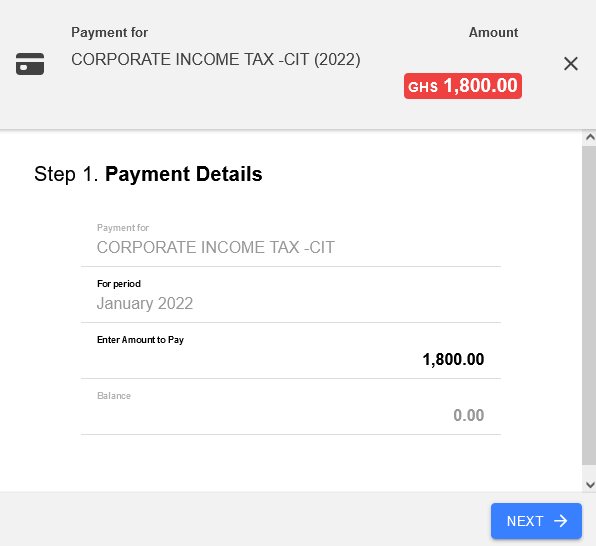

You’ll then be redirected to the Application Details page. If the page shows the name of your business correctly, then you can proceed to enter the amount you are paying for that particular tax or invoice.

The next destination is the Checkout Page where you’ll find an invoice number has been generated for you and the total amount you are to pay is displayed.

If everything there is accurate, click on the bright yellow Pay button that also mentions the total amount you’re paying. A pop-up window should appear showing you all the options available to you to make your tax payment via. These include:

- Bank Card

- Mobile Money

- Scan & Pay

- Pay with *222#

- Pay at Bank

If you select to pay with your Bank Card (we are assuming that all Visa, MasterCard and GH-Link cards should be acceptable), a pop-up allows you to enter your Card Number, Name on Card, Expiry Date and CVV (Card Verification Value, usually the 3 digit number at the back of your card.)

If you select to pay with Mobile Money, you’ll be able to complete your payment via any of the 3 main mobile money networks in Ghana, MTN Mobile Money, Vodafone Cash and AirtelTigo.

You simply select the network you desire and follow the prompts shown. Disclaimer, if you’re paying via MTN Mobile Money, they require that the number you signed up to Ghana.GOV with be the same number of the wallet you’re paying with. (We saw no such notice with the other 2 networks)

Also note that if paying via mobile money, there are limits to the total amount you can pay. MTN Mobile Money maxes out at GHc5,000 in transactions per day whilst Vodafone Cash and AirtelTigo Money have a maximum transaction amount of GHc2,000 per day.

If you select the Scan & Pay option, then a QR code will appear on your screen allowing you to use the app of your choice to complete your payment.

The 4th option is a new one. You can make your payments on Ghana.GOV via the shortcode *222# on all networks. Selecting this option will generate a unique shortcode just for you with the invoice number included.

Dialing this shortcode on your phone will allow you to make payment for the invoice via any of the mobile money networks. (Note though that if you try paying for the invoice with an MTN Mobile Money wallet number different from the number registered to your Ghana.GOV account, it may not go through.)

Alternatively, if you dial *222# on your phone, you are presented with a menu to choose from:

- Invoices

- Pending Bills

- GRA

- RGD

If you select Invoices, you can enter an invoice number if you’ve already generated one on the Ghana.GOV platform.

Alternatively, you can select Pending Bills if you don’t have the invoice number available. This option will pull all unpaid invoices you’ve already generated and you can select from those.

Selecting the RGD option allows you to enter your company registration number and start the process to filing your annual returns or viewing your filing history.

Selecting the GRA option presents you initially with 3 options, UNIPASS, GRA Direct Payments and VIT.

And just like we did on the Ghana.GOV website, if we select GRA Direct Payments, we get a series of tax types to select from. Following the prompts will enable you generate an invoice of the amount you specify for whichever tax type you desire.

The final payment method available is Pay at Bank. Selecting this option shows you your Invoice Number and gives you the option to have the payment instructions sent either to your email address or phone number.

Sending the notification to your email account for example will have you receiving an email notification shortly. It states that you can pay your Ghana.GOV invoice at any branch of any licensed commercial bank across Ghana.

When paying physically in a banking hall, besides the money for payment, you’re going to need your invoice number so make sure you hold onto that. But since this whole article is about paying your taxes online, let’s also finish it online.

Depending on who you bank with, you may have the option to pay for your GRA invoices right from your bank account. The advantage of doing it this way is that you don’t have to pay any transaction fees to Visa, MasterCard or any of the mobile money networks that charge a fee.

Zenith bank for example allows you to pay Ghana.GOV via their mobile shortcode *966# and via their Corporate Internet Banking portal.

Dialing *966*3*111# pulls up a prompt allowing you to enter your invoice number generated on Ghana.GOV. This is under their Merchant Pay option. And following the prompts will allow you to complete your payment in no time.

If Corporate Internet Banking is your style, with Zenith, a menu called Pay for Services on the left side allows you to select the service Ghana GOV Payment. You enter the invoice number generated on Ghana.GOV and clicking the Verify button will instantly confirm the details of your invoice, allowing you to proceed with your payment.

Whichever way you decide to pay, it will be confirmed almost instantly once received by Ghana.GOV. You should expect to receive both email and text notifications of your successful payment. (These notifications are aside the ones you receive for successfully generating your invoice)

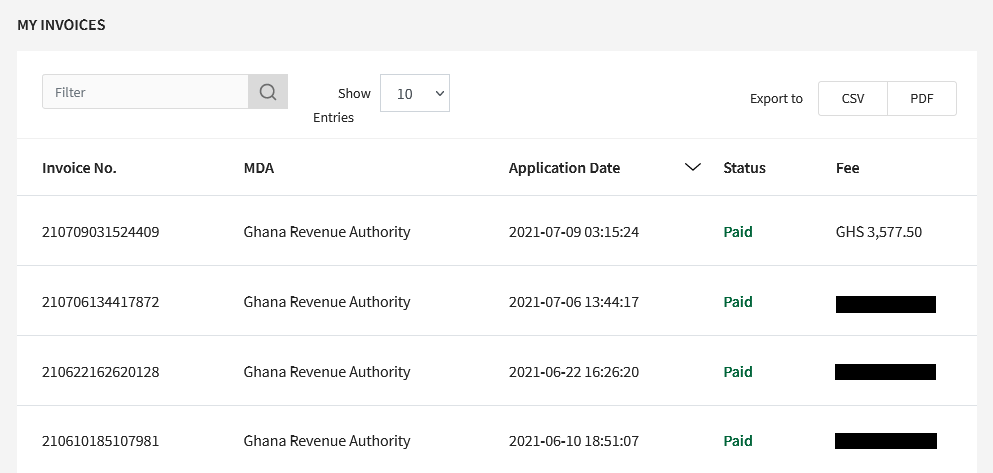

Whilst you’ll have your receipt emailed to you, you can also download it from your Ghana.GOV account. Simply navigate to your dashboard to display all your invoices.

Find the invoice you want to download. It should be marked paid. Clicking on it will open it up along with all its details.

Finally, clicking on Download or Print will give you a PDF copy of your invoice which you should certainly keep for your records.

You’ll also be able to download your invoice from the GRA’s taxpayer’s portal, view your statement, payments, etc.

Conclusion

It’s gradually becoming easier and easier to make payments for various government services online through not only the Ghana.GOV website, but other websites of the different ministries and institutions.

If you do encounter any issues with paying your taxes online through the Ghana.GOV portal, do feel free to contact them via:

Email on: help@ghana.gov.gh

Call on: 0307000575

Visit: Ministry of Communications Office Complex, 1st Floor Abdul Diof Road, Ridge. Accra.

Do let us know in the comments below about your experience.

Good Morning. Please can you delete a generated invoice after noticing you’ve made a mistake? if yes, how can it be done? Thanks.

Hi Mary, sadly, it doesn’t seem possible to delete a generated invoice. You’d simply have to generate a new invoice.

Invoices are valid for 30 days I believe and they are cancelled if left unpaid after that. A cancelled invoice won’t impact your account though.

Please have been frauded through short code *222#

An amount of 571gh credited to option no.3.GRA by a Mobile money fraudster.

Kindly assist immediately.

Thank you

Kindly contact through email for contact.

Hello Betty. For any issues with the *222# shortcode, you have to contact Ghana.GOV directly as they are the providers of the shortcode and the service.

You will find their contact here: https://www.ghana.gov.gh/about/?target=support

Email on: help@ghana.gov.gh

Call on: 0307000575

Visit: Ministry of Communications Office Complex, 1st Floor Abdul Diof Road, Ridge. Accra.

What are steps that we use to generate invoice please and can you generate invoice weeks after filing your tax

Hi Enock. Currently to the best of our understanding, you will need to visit The TaxPayers Portal of the GRA in order to generate invoices to be paid on Ghana.GOV.

To your second question, I would assume it might depend on how you filed your taxes. If your tax filing was done through the TaxPayer’s Portal, then you are able to click through to generate an invoice and pay for that anytime you want (although ideally before the necessary deadline).

If your filing was done offline at their offices, you would possibly be provided with a Tax Bill ID in order to pay the tax as a Domestic Tax Bill on the Ghana.GOV portal.

The customer service representative should pick our calls. I have been calling for more than 2 hours.

We’re sorry to hear that, Tawiah. We would recommend trying their other channels as well. Hopefully one will work so you needn’t go to their offices.

I generate one invoice twice. If after 30 days and the unpaid invoice is cancelled, does it get taken off my dashboard? How do I take it off if it doesn’t get taken off?

Hi Ernest. To the best of our knowledge, cancelled invoices aren’t taken off your dashboard automatically and sadly there’s no option to have them taken off either.