NB: We’ve received recent reports that the PayPal integration in Flutterwave is no longer popping up. This is the official statement we received:

“Please be assured that we are aware of the situation; the Paypal payment option is not available at the moment. We kindly advise that you advise your customers to make use of other payment methods.”

There have been a lot of articles written over the years on how to accept PayPal payments in Ghana, how to create a verified PayPal account, and more. This is because so many people want a PayPal account in order to either send or receive payments from around the world.

Being unable to accept international payments is one of the biggest frustrations for online businesses in Ghana.

Because we work with businesses, helping them get online, creating business websites and enabling them attract customers, a lot of them inform us that they want to accept payments from abroad, especially via PayPal.

PayPal is one of the largest payment providers in the world, with well over 377 million users currently.

pymnts.com

And the reasons are simple. International customers have far more disposable income to spend. And because PayPal is a trusted brand, it is easier to make sales if you accept PayPal.

Table of Contents

Accepting PayPal Payments via Flutterwave

If you’ve already read our article on the Best Payment Gateways in Ghana to Accept Online Payments, you’d have noticed that in our section on international payments, Flutterwave come out on top (followed by DPO).

Well Flutterwave have now significantly outdone themselves. In March this year, they announced a partnership that allows their merchants to accept PayPal payments as just one of their many different payment methods.

The news sounded too good to be true but the momentous occasion was marred a little by some technical challenges along with a terrific amount of confusion.

Confusion as to whether you still needed a PayPal account or not, whether it was open to all countries in Africa or only some, whether it was restricted to merchants only or individuals were also eligible, etc.

We do hope that they bring out a lot more clarity in their documentation because there are currently contradicting statements on different parts of their website over these very issues.

That being said, what we can vouch for is the fact that we as a business (limited liability company) on Flutterwave are currently able to receive PayPal payments from our international customers without the need for a PayPal account.

The money is received just like any other payment and is settled into our bank account. And that’s good news!

How does the PayPal payments on Flutterwave work?

Making a PayPal payment via Flutterwave’s integration works as smoothly as any other payment system.

Whether you’re being paid via a payment link or an online shopping cart integration, the PayPal option becomes visible the moment you reach the Flutterwave checkout pages in a PayPal enabled currency like USD. We’ll show you an example via a payment link.

On this payment link, once the basic details are entered and you hit the Pay button, you are presented with payment options of which a Pay with PayPal option shows.

Tapping this option reveals a bright yellow Proceed to PayPal button.

A black redirect screen shows briefly as the client is transferred to PayPal to authorize the payment for the amount specified.

You then land on PayPal’s website where you can log into your account.

When successfully logged in, PayPal will confirm the amount you are paying for and the payment option that you prefer.

If everything looks good, hitting the Pay Now button will complete your transaction and redirect you back to Flutterwave, confirming that your payment is complete.

It’s at this point that you the merchant (or we in this case) get an alert from Flutterwave that a payment has been made.

And logging into your Flutterwave dashboard, you’ll see the payment that’s been received. You can see the words Paypal_fw by the transaction, indicating that the transaction was facilitated by Flutterwave’s PayPal integration.

This actually also appears in the email notice as well.

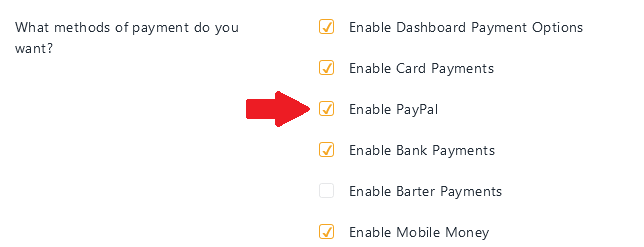

Once your account is set up and verified, you can then go to Settings > Account Settings in order to Enable PayPal as a payment option. (If you can’t enable the PayPal option, it may mean you haven’t provided Flutterwave sufficient documentation or your registered entity may not be currently eligible. You should contact them directly in such cases.)

Once that is enabled, you are now ready to accept online payments via PayPal. Congratulations!

How do I sign up for a Flutterwave account?

If you haven’t already, you can sign up with Flutterwave by going to their website and clicking on Create Account.

From what we gather, you can sign up for a Flutterwave account if you’re in any of the following 15 African countries:

- Cameroon

- Côte d’Ivoire

- Egypt

- Ghana

- Kenya

- Malawi

- Mauritius

- Morocco

- Mozambique

- Nigeria

- Rwanda

- South Africa

- Tanzania

- Uganda

- Zambia

Once you sign up, you will be required to select the type of account you want. Each account has different capabilities and verification requirements.

We have a registered business account with Flutterwave (Limited Liability Company) so that’s what we can confirm works, if you plan on accepting PayPal payments. If we have information on how the other account types perform, we’ll let you know.

The requirements currently for verifying your registered business account with Flutterwave are:

- Incorporation documents

- Directors’ names, IDs

- Corporate bank account details

- Operational business address

- Verifiable website URL (where required)

- Operating license (where business is regulated)

- Estimated monthly sales

You can find the requirements for all entity registrations here

Note: their requirements do mention a verifiable website URL where required. We aren’t sure of when this is required however if you do need a domain name or website for your business, you can always secure one below.

Find Your Perfect Domain

Does Flutterwave provide me with a PayPal account?

You do not need a PayPal account to accept payments via PayPal if you have a Flutterwave account for your business. And no, Flutterwave doesn’t give you nor create a PayPal account for you.

Rather, PayPal is just an additional payment method via which your clients and customers can use to make payment to you for your goods and services.

The way a payment processor enables you accept payments from MTN Mobile Money, AirtelTigo Money, Vodafone Cash, Visa and MasterCard without having a specific account with each one of them is the same way Flutterwave allows you to accept payments from PayPal without having a PayPal account.

What are the fees charged for PayPal transactions?

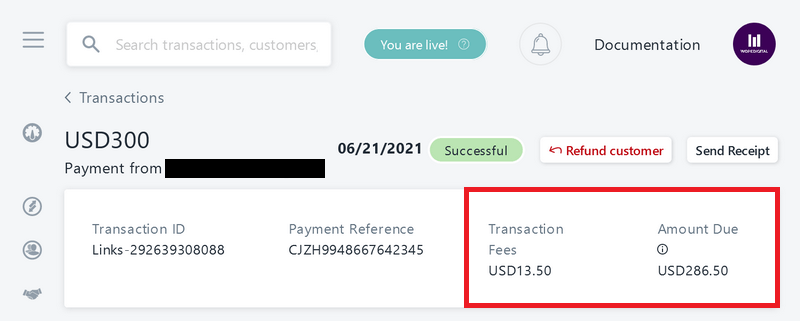

Whenever anyone pays you with PayPal through Flutterwave, the charge is 4.4% of the transaction value plus $0.30 per transaction.

For example, a client of ours made a payment of $300. That means that PayPal got $13.5 whilst we got $286.5.

Flutterwave didn’t charge a separate fee from what PayPal charged. This means that if they are making any money on these transaction fees, it’s already been negotiated behind the scenes with PayPal as to how much their share would be.

Are there any hidden charges or fees?

Yes, there is one hidden charge, based on our experience. This has to do with currency conversion rates.

Now you do have to understand that one important essence of a business is to make enough profit to support its employees and its operations. Without turning a profit, a business will eventually shut down and whatever services or benefits they provided will no longer be available.

So to that end, it is perfectly understandable that Flutterwave seems to make a bit of a profit with regards to currency conversions. What we want is to let you know upfront so you aren’t surprised later on.

The currency conversion issue is as follows. After deducting transaction fees and a GHc5 charge to send the money to our bank account, we had $285.66 left over.

So all other things being equal, what we needed was to get the Ghana Cedi equivalent of that into our bank account and we’d be good to go.

According to Google, that would have been GHc1,665.65 at a conversion rate of GHc1 = $0.171500.

But that’s not the conversion rate that Flutterwave uses. They use an internal conversion rate that is more favourable and profitable to them.

They converted the same amount at a rate of GHc1 = $0.187438 which valued our money at GHc1,524.

This basically means that Flutterwave takes approximately 8.48% of the transaction value whilst PayPal takes 4.4%. That totals approximately 12.88% in transaction fees when accepting payments with PayPal on Flutterwave.

Some people might read this and consider it unacceptable or too expensive. That’s definitely a position you can take.

On the other hand, many businesses in Africa would be more than DELIGHTED to part with just a little over 10% of their income in order to accept payments from virtually anywhere in the world, with the PayPal brand backing that transaction.

We are of the latter camp. Considering how extremely difficult it is to find a payment gateway that enables you accept international payments reliably, much more PayPal payments, we think this is an option to consider.

At worst, you can adjust your prices for international transactions, now that you have a rough idea of the fees you’ll incur.

How long does it take for PayPal payments to reach my bank account?

It usually takes 5 working days for international payments to be settled via Flutterwave and PayPal is no different.

When an international payment is received, you’ll be alerted to the money’s arrival, but it’ll only arrive in your bank account 5 days later.

For example, our client paid us on the 21st of June, 2021.

Flutterwave alerted us that the payment would reach our bank account by the 26th of June.

True to their word, by the 26th of June, the money was ready to be moved to our bank accounts. (26th was a Saturday so we decided to wait till the 28th being a Monday before we completed the transfer. We’ve chosen to settle payments to our accounts manually rather than automatically.)

Which banks can PayPal payments be withdrawn to?

Your PayPal payments via Flutterwave can be withdrawn to any of the 23 banks in Ghana. These are:

- Absa Bank

- Access Bank

- ADB

- Bank of Africa

- CalBank

- Consolidated Bank Ghana

- Ecobank Ghana

- FBN Bank

- Fidelity Bank

- First Atlantic Bank

- First National Bank Ghana

- GCB Bank

- Guaranty Trust Bank

- National Investment Bank

- OmniBSIC Bank

- Prudential Bank

- Republic Bank

- Société Générale Ghana

- Stanbic Bank

- Standard Chartered Bank

- United Bank for Africa

- Universal Merchant Bank

- Zenith Bank

Aside these, Flutterwave lists an additional 49 entries that you can have your money transferred to.

The list does contain a few interesting entities, some we've never heard of and some that are no longer operational, but all the banks in Ghana are available on that list.

Can I receive a PayPal payment to my mobile money wallet?

Yes, you can. Once you’ve been paid via PayPal and the money is available in your Flutterwave account, you can have that money withdrawn to your mobile money wallet.

The options available are:

- MTN Mobile Money

- AirteTigo Money

- Vodafone Cash

Disclaimer: Flutterwave do list Airtel and Tigo separately although the two companies merged almost 4 years ago in 2017.

Can I send money to someone with a PayPal account?

No, you wouldn’t be able to send money to someone with a PayPal account via Flutterwave. The PayPal integration only allows registered businesses to receive payments via PayPal.

It doesn’t provide you with a PayPal account nor any of the other benefits of having a PayPal account.

Can Ghanaians pay me via PayPal?

Yes, any Ghanaian or resident in Ghana who wants to pay you via PayPal can do so successfully. We’ve tested this and there were no issues encountered.

But do remember that because Ghanaians can’t sign up for PayPal easily or normally, the vast majority of Ghanaians won’t have a PayPal account in order to pay you via PayPal.

If you’re looking for the most popular online payment method in Ghana though, that would be mobile money, so make sure you’re able to accept payments via all the mobile money networks.

How do I open a verified PayPal account in Ghana?

Whilst this guide has been for businesses that want to accept international payments with PayPal via Flutterwave’s integration, there might be reasons why you want a PayPal account still.

As previously mentioned, there are certainly major risks to that, including the possibility of your account and any funds in it being frozen or your account being limited or blocked.

That being said, you can certainly run a quick search in Google for various tutorials on opening up a PayPal account for yourself in another country, as Ghana is simply not an available option.

Why is Ghana blacklisted by PayPal?

Receiving payments via PayPal hasn't always been this straightforward. This is because PayPal has ensured that Ghana isn't one of the countries they do business with.

PayPal haven’t put out any official communication on why, however we have covered this in previous articles including one on the best payment gateways to accept payments in Ghana.

Right at the infancy of ecommerce in Ghana, PayPal encountered an excessive amount of fraud originating from Ghana. This included credit card fraud and people using PayPal accounts owned by others to perpetrate fraudulent transactions.

Their decision was to to block us, along with some other countries.

There have been various unsuccessful attempts to get Ghana off of PayPal’s blacklist. A Change.org petition was started over 8 years ago to try and get PayPal’s attention.

Whilst it has gathered almost 20,000 signatures at the time of writing, it doesn’t seem to have moved PayPal in any way with regards to Ghana. (They did take Nigeria off their blacklist in 2014, but they haven’t shown any love to Ghana.)

The vice-president of Ghana, Dr. Mahamudu Bawumia mentioned on the 10th of May, 2018 that Ghana would become fully PayPal compliant by 2020. This was said at the launch of the first phase of Ghana’s mobile money interoperability system.

The promise was conditioned on a lot of hard work by all stakeholders involved, however that date has long passed and all we currently know is that getting PayPal to do business in Ghana has been a tough nut to crack.

In attempts to get around the blocks and restrictions, you will find many articles online on how you can accept PayPal payments in Ghana, each with some interesting steps to be completed.

These include:

- Signing up for your account from Togo, Kenya, Lesotho or another country

- Having a foreign phone number in one of these countries

- Using a VPN (Virtual Private Network) to hide your IP address from PayPal

- Withdrawing PayPal earnings to specific types of debit cards

- Having someone in a different country open and/or manage your PayPal account for you

Most of these are loopholes in PayPal’s systems, but with every loop hole found to create and use a PayPal account, they eventually plug them.

And that leads to quite an amount of weeping and gnashing of teeth, because your account, with your hard earned money in it, might get locked or frozen with no way to comply with their further verification checks.

Here are just a few screenshots on Twitter of people lamenting their accounts being locked or permanently limited by PayPal.

What follows is an overview of the best way to accept PayPal payments in Ghana without having a PayPal account.

Payment Gateways That Accept PayPal

If you’re in one of the few countries that PayPal absolutely refuses to do business with, your best bet might be to sign up with a payment gateway that processes PayPal payments for you.

It’s a very interesting thing. PayPal is more than just a payment provider, it’s actually become a payment method or a digital wallet if you prefer.

The very way that some payment processors accept payments via MTN Mobile Money or Vodafone Cash is the same way other payment processors accept PayPal as a payment method.

To put it simply, all you have to do to accept PayPal payments in Ghana is to sign up with a payment gateway that offers PayPal as a payment method.

Here are a few:

The SAD REALITY THOUGH is that just as PayPal doesn’t accept sign ups from Ghana, neither of the 6 payment gateways listed above accept businesses from Ghana either (to the best of our knowledge)!

For whatever reason that Ghana is blacklisted by PayPal, many other payment processors have also found good reason to blacklist Ghana as well.

What’s amazing is that a company like Avangate (formerly 2Checkout) retroactively banned accounts from Ghana. They used to accept businesses from Ghana but got up one day and said, “We don’t want you anymore!”

And so it’s been a string of bad news on all sides if you wanted to accept PayPal payments in Ghana.

Until now!

Conclusion

If you’re a business and you’ve signed up with Flutterwave, let us know in the comments whether you’re able to successfully processing PayPal payments through your account or not.

We always inform our own clients not to rely on a single payment platform for processing their payments and we’d like to recommend the same to you.

As great as it is that Flutterwave is currently processing PayPal payments, you can never tell whether they’re going to run into significant technical issues or some other problem.

Outside of that, we’d like to congratulate them on truly making it possible to accept PayPal payments in Ghana without a PayPal account.

Thanks very much, Mr Seth.

Your articles are always highly informative and elaborate. Very useful and enlightening.

Thumps up!

Thank you, Mr. Samuel. It’s always our pleasure. 👍🏽

I don’t know about you but the “Pay with PayPal” option on my Flutterwave checkout modal is no longer there. i would be surprised if was available on your on your site (as you’ve explained in this article). Maybe you spoke too early?

Hi Kofi, thanks for the info. Yes, it does appear that the “Pay with PayPal” option is no longer showing, even from our end. We’ve updated the article with a notice as we look for official confirmation on this.

Yes, it seems we were a little prescient regarding our comment at the end of the article: “As great as it is that Flutterwave is currently processing PayPal payments, you can never tell whether they’re going to run into significant technical issues or some other problem.”

Let’s hope they can get back up and running smoothly as soon as possible.

Thank you for an insightful useful information.

You’re most welcome, Esther.